Classic Cars as Investments: How to Assess Value

In the world of investments, the allure of classic cars holds a special place. Beyond their aesthetic appeal and historical significance, classic cars have become a tangible asset class sought after by enthusiasts and investors alike. However, delving into classic car investment requires more than just a love for vintage automobiles; it demands a thorough understanding of how to assess their value. In this blog, we’ll explore the intricacies of classic car investments and provide insights into how to evaluate their worth.

Understanding the Appeal of Classic Cars

Classic cars evoke nostalgia and embody the craftsmanship of a bygone era. They represent a tangible link to history, capturing the essence of different periods and cultures. Beyond their sentimental value, classic cars often possess unique features, limited production numbers, and iconic designs that contribute to their allure.

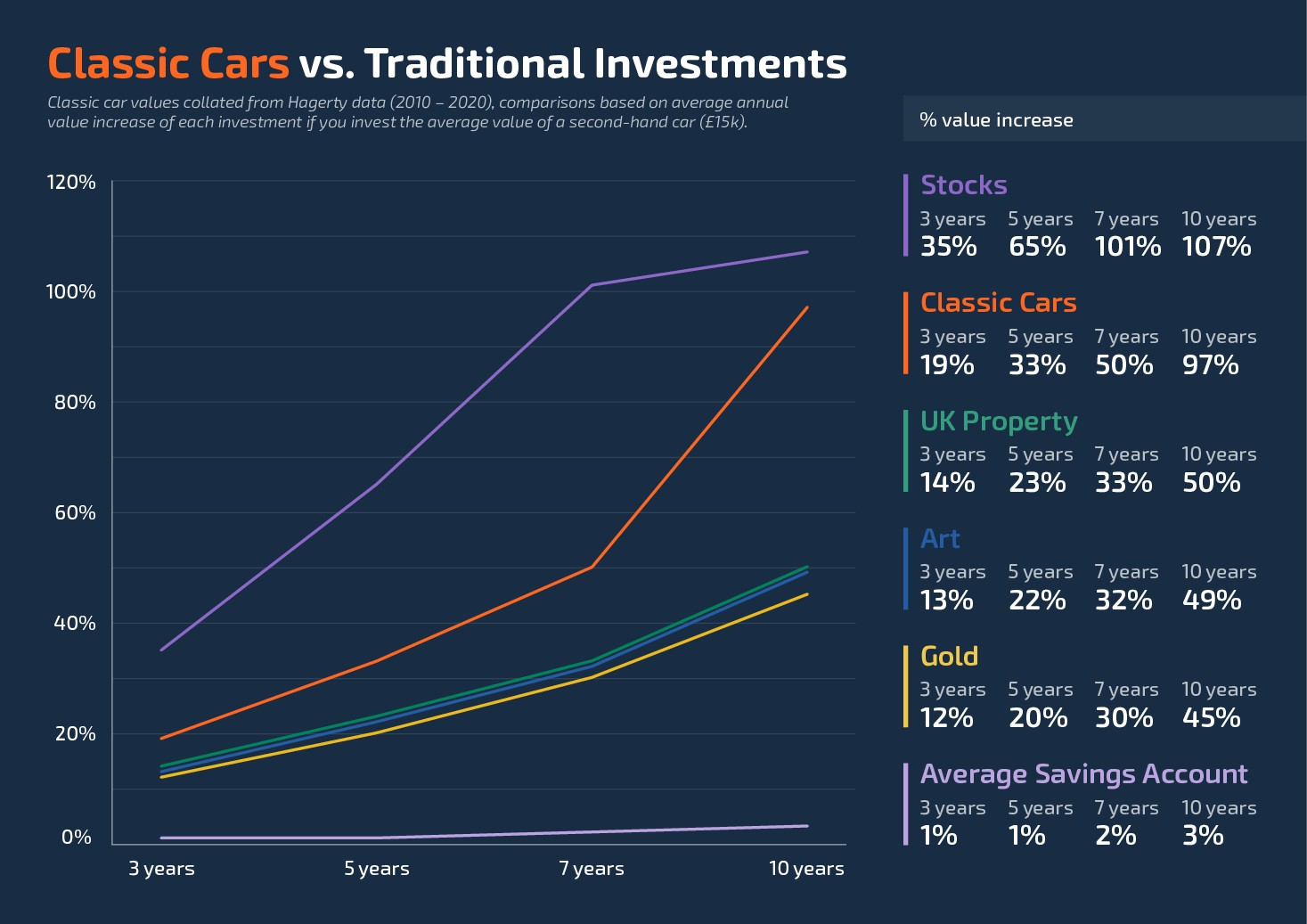

Moreover, classic cars have demonstrated the potential for substantial financial returns. Unlike traditional investments such as stocks or real estate, classic cars offer a tangible asset that can be enjoyed while potentially appreciating in value over time. However, investing in classic cars requires a nuanced approach to assessing their worth and understanding the factors that influence their market value.

Factors Influencing Classic Car Value

- Rarity and Desirability: Rarity plays a significant role in determining the value of classic cars. Limited production numbers, particularly of iconic models, can significantly enhance the desirability and drive up prices. Factors such as historical significance, racing pedigree, and celebrity ownership can further increase a car’s allure.

- Condition: The condition of a classic car is paramount in determining its value. A well-maintained, original example will typically command a higher price than a vehicle requiring extensive restoration. Factors such as mileage, maintenance history, and the presence of original parts can greatly influence valuation.

- Authenticity and Originality: Authenticity is crucial in the world of classic cars. Vehicles with original components, including engine, chassis, and interior, are generally more desirable than those with aftermarket modifications or non-original parts. Documentation such as build sheets, service records, and ownership history can also bolster authenticity and enhance value.

- Market Trends and Demand: Like any investment, classic car values are subject to market trends and fluctuations in demand. Understanding the preferences of collectors and monitoring market dynamics can provide valuable insights into which models are poised for appreciation.

- Restoration Quality: While some collectors prefer unrestored, “survivor” cars, others seek meticulously restored examples. The quality of restoration work, including attention to detail, craftsmanship, and adherence to original specifications, can significantly impact a car’s value.

- Provenance: The provenance of a classic car, including its ownership history and any notable events or competitions it has participated in, can add to its appeal and value. Vehicles with well-documented histories and connections to famous individuals or significant moments in automotive history often command premium prices.

Evaluating Classic Car Investments

- Research and Due Diligence: Before investing in a classic car, conduct thorough research on the model, its production history, and market trends. Familiarize yourself with common issues and potential pitfalls associated with specific makes and models. Additionally, seek expert advice from appraisers, collectors, and reputable dealers to gain insights into valuation and investment potential.

- Inspect and Authenticate: When evaluating a classic car, perform a comprehensive inspection to assess its condition, authenticity, and originality. Look for signs of wear, corrosion, and structural damage, and pay attention to details such as matching numbers, factory markings, and original paintwork. If possible, enlist the services of a qualified inspector or restoration specialist to provide an unbiased assessment.

- Document and Verify: Verify the authenticity of the classic car through documentation such as build sheets, ownership records, and service history. Ensure the vehicle’s VIN (Vehicle Identification Number) matches its documentation and investigate any discrepancies or inconsistencies. Additionally, request a comprehensive appraisal from a certified appraiser to establish an accurate valuation.

- Consider Future Value Potential: While historical performance can provide insights into a classic car’s investment potential, consider factors that may influence its future value. Assess the model’s cultural relevance, technological significance, and demographic trends to gauge its long-term appeal to collectors. Additionally, stay informed about legislative changes, environmental regulations, and advancements in automotive technology that may impact the classic car market.

- Diversify Your Portfolio: As with any investment strategy, diversification is key to mitigating risk and maximizing returns. Instead of focusing solely on a single make or model, consider diversifying your classic car portfolio across different eras, brands, and market segments. By spreading your investments, you can minimize exposure to market fluctuations and capitalize on opportunities across various segments of the classic car market.

Conclusion

Investing in classic cars offers a unique opportunity to combine passion with profit potential. However, navigating the world of classic car investments requires a discerning eye, thorough research, and careful consideration of various factors that influence value. By understanding the appeal of classic cars, evaluating key factors such as rarity, condition, authenticity, and market trends, and conducting due diligence when assessing potential investments, enthusiasts can capitalize on the timeless allure of vintage automobiles while potentially realizing significant financial returns. Whether you’re a seasoned collector or a novice investor, approaching classic car investments with diligence and strategic foresight can pave the way for a rewarding and enjoyable journey in the world of automotive nostalgia.

Remember, classic cars are not just investments; they are pieces of history, art, and culture that deserve to be preserved and appreciated for generations to come. So, whether you’re behind the wheel of a meticulously restored classic or admiring the beauty of a Concours-winning masterpiece, cherish the timeless appeal of these automotive icons and the stories they tell about our collective past.

Invest wisely, and may your classic car journey be filled with memorable rides and rewarding experiences on the road ahead.

Passionate Writer, Blogger and Amazon Affiliate Expert since 2014.